U.S. Export Administration Regulations: They Cover More Foreign-Made Products Than You Might Think

Co-Author, Cynthia Roberts, Senior Consultant at Traliance

Export controls trivia time! Which of the following reasons is sufficient to exclude an item from coverage under U.S. export control regulations?

A) The item is not located in the U.S.

B) The item was not made in the U.S.

C) The item was not made in the U.S. and is not located in the U.S.

D) None of the above.

To the surprise of many, the correct answer is (D) None of the above. Although most of the Export Administration Regulations (EAR) focus on U.S. exports, it also covers diverse activities including transfers of certain foreign-made products. As written in 15 CFR 730.5(b),

“In some cases, exports from abroad, reexports or transfers (in-country) of items produced outside of the United States are subject to the EAR when they contain more than the de minimis amount of controlled U.S.-origin content as specified in § 734.4 of the EAR or when they are the direct product of specified “technology,” “software,” or a “plant or major component of a plant” as specified in § 736.2(b)(3) of the EAR.”

Does this wording leave your head spinning? This article walks through key things your organization should know about verifying when a foreign-made product is subject to the EAR and demystifies the de minimis rule.

Foreign-Made Items Subject to the EAR

There are ten General Prohibitions in the EAR that are overarching restrictions on anything that is “subject to the EAR”. General Prohibition Two (15 CFR 736.2(b)(2)) restricts transfers of:

- foreign-made commodities that incorporate controlled U.S.-origin commodities,

- foreign-made commodities that are “bundled” with controlled U.S.-origin software,

- foreign-made software that is commingled with controlled U.S.-origin software, and

- foreign-made technology that is commingled with controlled U.S.-origin technology

Therefore, any commodity, software or technology using controlled U.S.-origin items in its creation should be treated as subject to EAR until a full analysis of requirements, including any required reporting to the relevant federal agency (Bureau of Industry and Security (BIS) under the U.S. Commerce Department, proves otherwise.

This analysis should first consider the status of a commodity under 15 CFR 734.9 — Foreign-Direct Product (FDP) Rules. This defines when an item is a “direct product” of specified “technology” or “software,” or is produced by a plant or ‘major component’ of a plant that itself is a “direct product” of specified “technology” or “software.” Products that meet the definition outlined in 15 CFR 734.9 are subject to the EAR, regardless of where they were produced. In some cases, the involvement of the People’s Republic of China, Russia, or Belarus can more readily trigger these FDP rules. In fact, BIS published a final rule (87 FR 62186, effective in October 2022) that contains two new FDP rules for advanced computing and ‘‘supercomputers’’ under 734.9(h) and (i).

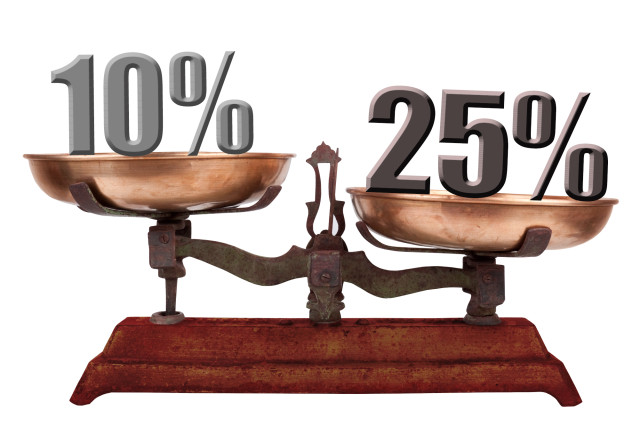

Another trigger causing foreign-made items to be subject to the EAR is when they contain U.S.-origin export-controlled content. This means the “content” is described by a specific export control classification number (ECCN) on the Commerce Control List (15 CFR 774 Supplement No. 1). But it depends on the amount of U.S. controlled content. That’s where the de minimis values come into play. De minimis is a Latin concept meaning “of no significance” or “not worthy of consideration”. Let’s walk through three cases:

- No de minimis value applies

- 10% de minimis rule

- 25% de minimis rule

However, 15 CFR 734.4 — De minimis U.S. content defines two thresholds which may exclude such a product if the level of controlled content is sufficiently small.

Case 1: When De Minimis Can Not Be Applied

15 CFR 734.4(a) and 15 CFR 734.4(b) outline specific items for which no de minimis rule applies. For certain items, as defined in these sections, all foreign-made items are subject to the EAR with even the tiniest amount of U.S.-origin controlled content. Components which trigger these restrictions include various export-controlled integrated circuits, computing, software and encryption items, as well as most military-relevant items (e.g., ECCNs in the 500 or 600 series).

In all other cases, either 10% or 25% of controlled U.S.-origin content is needed to trigger an item to be “subject to the EAR”.

Case 2: The 10% De Minimis Rule

Where de minimis is possible and the percentage of controlled U.S.-origin content is exceedingly small (10% or less), the foreign-produced items are not subject to the EAR. This occurs when foreign commodities or software incorporate controlled U.S.-origin items and/or are bundled with U.S.-origin software such that those are 10% or less of the total value of the foreign-made item. Foreign technology commingled with or drawn from controlled U.S.-origin technology which is valued at 10% or less of the total value of the foreign technology may also qualify under the 10% de minimis rule after appropriate reporting per 15 CFR 734(b) Supplement No. 2. In these cases, the foreign-produced commodity, software or technology is not subject to the EAR and BIS does not have jurisdiction over the export.

Case 3: The 25% De Minimis Rule

Where de minimis is possible and controlled U.S.-origin content is minor (25% or less), the foreign-produced items are only subject to the EAR for any transfer involving a country from Country Group E:1 or E:2 of 15 CFR 740 Supplement No. 1. This means a foreign-made commodity, software, or technology is not typically subject to the EAR if even it has incorporated controlled U.S.-origin items and/or been bundled with U.S.-origin software such that those are 25% or less of the total value of the foreign-made item, and where appropriate reporting has been done for the foreign-made technology. Such items may be sent to most destinations without additional consideration of BIS licensing requirements. However, transfers involving any Group E:1 or E:2 country remain subject to the EAR and licensing requirements need to be determined.

How to Calculate the Percentage of U.S. vs. Foreign-Made Content

Details on accounting and arms-length fair market valuation for calculation of the percentage of U.S.- content are in 15 CFR 734 Supplement No. 2. There are five key steps:

- Determine the ECCN of all U.S.-origin items incorporated into the foreign-made product.

- Determine license requirements for those ECCNs to the foreign-made product’s destination country.

- Determine the market value for U.S.-origin items that would not ship “no license required.”

- Determine the market value of foreign-made product in the market where it is sold.

- Divide the total value of all U.S.-origin controlled content (from no. 3) by the foreign-made product value (from no. 4), then multiply the resulting number by 100. That is the percentage to then compare to the de minimis value of either 10% or 25%.

- Ensure de minimis recordkeeping per 15 CFR 734.4(g).

Submitting a Report to BIS

If foreign technology is commingled with or drawn from controlled U.S.-origin technology, a one-time report is required before reliance on de minimis rules. This is to permit the U.S. Government to evaluate whether calculations were performed correctly.

15 CFR 734(b) Supplement No. 2 details the required contents of the report, as well as options for sending it to BIS. For thirty (30) days immediately following filing, BIS may reach out with questions, corrections or a rejection. Upon receipt of any such communication from BIS, parties may not rely upon the calculations and may not use the de minimis rules for technology, until BIS has further indicated that such calculations were performed correctly. If the thirty days have passed and BIS has not contacted the submitter, then all parties may rely upon the calculations unless and until BIS instructs otherwise.

What’s Next?

If your foreign-made product is subject to the EAR as a foreign-direct product because the relevant de minimis threshold for U.S.-origin controlled content is exceeded—or because the foreign technology de minimis report has not yet reached the 30-day milestone—your company or university must continue to comply with all regulatory requirements as detailed throughout the EAR. For this compliance analysis, you should comply with all licensing procedures for each ECCN of all US-made components.