Which Export Classification? ECCN vs Schedule B

Not all export classifications are the same. Do you understand which export classification is needed for your international shipment, export of technology, or deemed export transactions?

Here are 4 key points about U.S. export classification numbers that will help you figure out which number is relevant – and when. We explain the difference between these export numbers, what these export classification numbers stand for, the government regulations in which they are rooted, and when you need to use them.

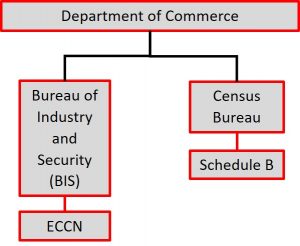

Department of Commerce has Two Different Export Numbers

While both export classification numbers, Export Control Classification Numbers (ECCNs) and Schedule B Numbers, stem from the U.S. Department of Commerce regulations, they are driven by two different agencies with the Commerce Department: BIS and the Census Bureau, respectively. BIS administers the Export Administration Regulations or EAR.

Export Control Classification Numbers vs Schedule B

Export control classification numbers (ECCNs) are often confused with Schedule B numbers. It’s not uncommon for me to ask a supplier for an ECCN of their product, and in return I’m provided with a Schedule B number. While they are indeed both export codes, they are entirely different numbers and a direct match-up between the two does not exist (unfortunately.)

Schedule B numbers are 10-digit export codes for exporting physical goods (not technology) out of the United States. Only the U.S. government uses Schedule B numbers as their purpose is to track statistics around U.S. exports. The first 6 digits of a Schedule B number is the same a Harmonized Tariff Schedule (HTS) Number, which is an internationally-used number that is defined by the World Customs Organization.

For both ECCNs and Schedule B’s, scientific and technical parameters play a significant role in properly classifying an item. Everything from chemical composition or processing method can affect either export code. It’s critical to leverage personnel who are knowledgeable about the scientific properties and parameters behind an item when classifying it.

3 Must Have Export Compliance Templates to Strengthen Your Compliance Program

Do you need help keeping track of all your export classifications, export licenses, and export compliance risks?

Use our easy-to-use templates to create a management system that’s perfect for universities and small to medium sized companies.

Where Should We Send Your Templates?

Which U.S. Export Number Matters?

As with all export transactions…it depends. It depends on the nature of the items (hard goods, software, or technology) being exported. Sometimes both numbers are required. If the EAR’s Commerce Control List (CCL) does not have an ECCN that describes your item, then the item likely adopts the EAR99 classification (assuming no other exclusions apply.) It is a requirement to report Schedule B numbers in the Automated Export System (AES) when shipments are valued over $2,500 or if the the item requires a license from BIS. This is one example of a linkage between the EAR and other federal government regulations.

Why are ECCNs are Important?

The ECCN is critical to determining if a BIS license is required before an export or deemed export can legally occur. An improperly classified item is dangerous as it can lead to deciding that a BIS license is not required…when it really is! Many times, the ECCN plays a role with identifying which license exceptions apply to a transaction. The ECCN must be also be stated on shipping documentation, along with the Destination Control Statement (recently harmonized between the Department of State and Department of Commerce.)

When you are analyzing or seeking an export classification number, remember these points to determine which one(s) matter to your export transaction.